Introduction

For small businesses, managing invoices and payments efficiently can be the difference between steady cash flow and financial headaches. Fortunately, there are numerous invoice and billing software options designed to save time, reduce errors, and improve client experience. In this blog, we will explore top solutions that make billing simple, fast, and accurate.

Table of Contents

Why Small Businesses Need Efficient Billing Software

Transitioning from manual spreadsheets to automated billing systems has several benefits. First, it ensures accuracy in invoicing, which helps maintain client trust. Second, it reduces the time spent on administrative tasks, allowing business owners to focus on growth. Moreover, many software options provide analytics, reporting, and payment tracking, giving small businesses a competitive advantage.

Top Invoice & Billing Software Solutions

1. QuickBooks Online

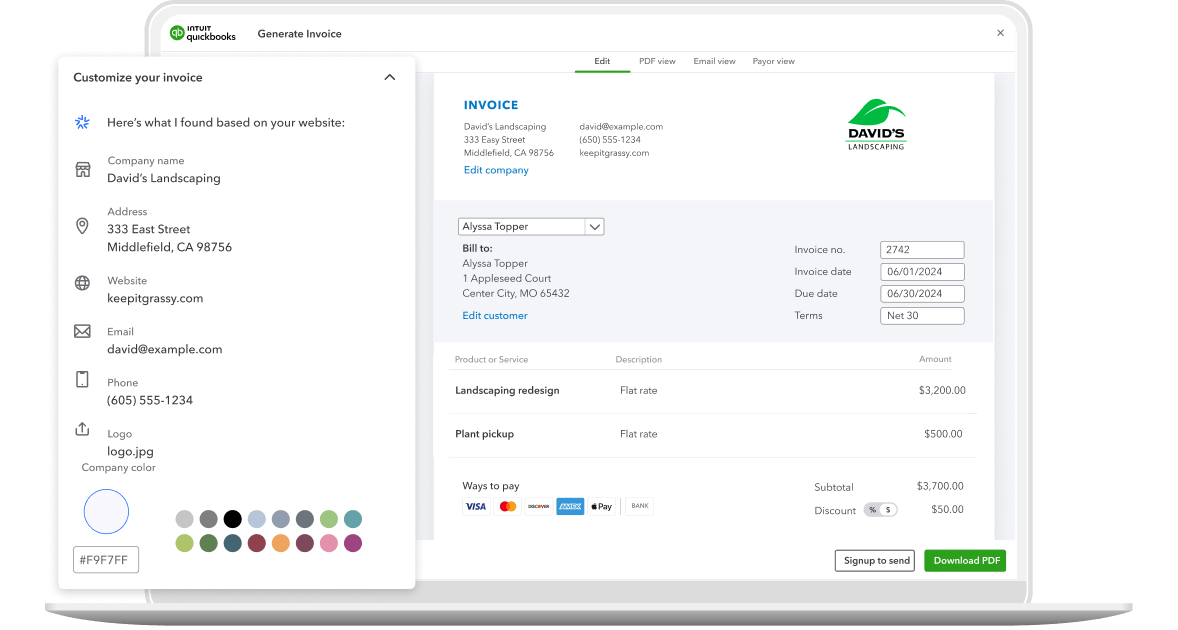

QuickBooks Online remains one of the most widely used solutions in the invoicing and billing space, and for good reason. This platform offers seamless invoice creation, automated payment reminders, and smooth integration with multiple payment gateways. Additionally, it provides detailed financial reporting tools, allowing small business owners to monitor cash flow, revenue, and expenses in real time.

Another major advantage is its scalability. Whether you are a freelancer just starting out or a growing small business, QuickBooks can adapt to your needs. Because it is cloud-based, you can also access your financial data anywhere, ensuring complete flexibility.

Learn more about QuickBooks Online

2. FreshBooks

FreshBooks is often praised for its simplicity and user-friendly design. It is especially helpful for entrepreneurs and small teams who need invoicing software without a steep learning curve. In addition to invoice creation, it provides built-in time tracking, recurring billing options, and expense management tools.

Moreover, FreshBooks shines when it comes to client relationships. The platform allows you to send professional-looking invoices, track project hours, and accept online payments, all in one place. Thanks to its intuitive dashboard and strong customer support, business owners can focus more on their work and less on administrative tasks.

3. Zoho Invoice

Zoho Invoice is part of the larger Zoho ecosystem, which makes it an attractive choice for small businesses looking for integration and flexibility. It offers a full suite of billing tools, including customizable invoices, automated payment reminders, and online payment options.

What sets Zoho Invoice apart is its ability to connect seamlessly with other Zoho applications, such as Zoho CRM or Zoho Books. As a result, small business owners can manage multiple aspects of their business within one ecosystem. Additionally, Zoho provides detailed reporting features that make financial decision-making more efficient.

4. Xero

Xero is another highly popular invoicing and accounting software solution trusted by small business owners worldwide. Known for its cloud-based capabilities, Xero allows you to send invoices instantly, reconcile payments quickly, and generate detailed financial reports with ease.

One of the key benefits of Xero is its focus on reducing manual errors. With bank reconciliation features and automated transaction matching, you can streamline financial tasks and maintain accuracy. Furthermore, because Xero is designed with collaboration in mind, your accountant or financial advisor can log in remotely and access real-time data whenever needed.

5. Wave

For small business owners on a tight budget, Wave is a fantastic option. Unlike many paid tools, Wave offers its invoicing, accounting, and receipt-scanning features completely free of charge. Despite being free, it delivers essential tools that allow businesses to send professional invoices, track payments, and manage receipts without hassle.

In addition, Wave integrates with payment processors, enabling businesses to accept online payments if desired. While it may not provide the advanced features of QuickBooks or Xero, it is still a strong contender for freelancers, solopreneurs, and startups that need a reliable financial management solution at zero cost.

How to Choose the Right Billing Software

Choosing the right software requires careful consideration. First, assess your business needs, including the volume of invoices, payment methods, and reporting requirements. Second, consider pricing and scalability, ensuring the software grows with your business. Finally, check integrations with your existing tools and review customer support quality. Using a trial period can also help determine the best fit before committing.

Conclusion

Investing in the right invoice and billing software can save small businesses time, reduce errors, and improve cash flow management. QuickBooks Online, FreshBooks, Zoho Invoice, Xero, and Wave are all excellent options to consider. By choosing the right solution and leveraging its features, small business owners can focus more on growth and less on administrative headaches.